Dear Clients and Friends,

In the report found here, we highlight m&a values and trends in the dozen+ sectors of the information technology universe that we follow, and sometimes lead. Please see the May Market Update report, here.

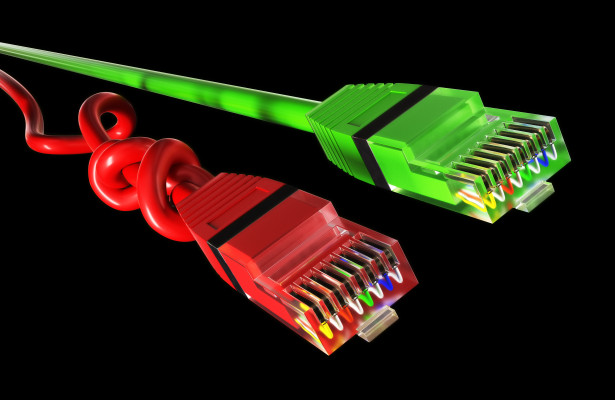

In our business we advise a fair number of mid-sized companies that are owned by early investors and entrepreneurs. Many of these companies are “upstarts” – some of which are looking to combine streaming content with technology to disrupt the established order. Eventually, many of these firms expect to become buyers or sellers – or to raise capital – and that’s where we come in. The value of these firms to potential investors or buyers is based not only on what they have accomplished so far, but also on their opportunity to grow significantly further. In that context, we watched with interest this week’s federal appeals court action regarding “Net Neutrality”. We’re not neutral.

The major cable and telecom companies – firms like AT&T and Comcast – argue that the forces of capitalism should rule – they believe that that regulations that would keep them from blocking, throttling or giving “fast lanes” to some content providers but not others violate their rights – and keep them from making money. They assert that the government has no right to force a book store to promote all books equally – no right to bar that book store from featuring some books but not others and the same approach should apply to them. The new FCC Chairman and the administration in DC seem to agree.

We are capitalists, and where there is true competition, we would agree with the position of the big ISPs, too. But in too much of the world, we see that ISPs are not like book stores – they have conspired with politicians to ensure that they are the only way to get some streaming content to the ultimate users. They are defacto regional monopolies that have the ability to make or break a content provider. Amazon, Disney, Google, Netflix or Facebook (as examples) may be able to pay the ISPs to facilitate faster streaming content, but how will that impact the next upstart that cannot pay? Further, many of the ISPs are themselves content providers as well as content deliverers. What the big Telcos and ISPs seek is unfettered monopoly pricing power. In our view that approach has the potential to harm many an upstart – and thereby negatively impact investor and buyer demand and values for affected companies.

The revolution in streaming content is just beginning. Let’s let it go and see what develops. Long live Net Neutrality.

Some of the more interesting deals this past month are profiled on the pages that follow in the report found here. A few of them include:

- TBG (Zurich, Switzerland) agreed to acquire Telvent DTN from Schneider Electric for $900mm, an implied 4.2x LTM revenue,

- Travelers (NYSE:TRV) agreed to acquire Simply Business from Aquiline Capital Partners for $490mm,

- Warburg Pincus (New York, NY) agreed to acquire a 35% stake in Avaloq for $304mm, valuing the company at an implied 1.6x LTM revenue and 10.5x LTM EBITDA,

- Thales (ENXTPA:HO) agreed to acquire Guavus for $215mm,

- Qualtrics (Provo, UT) raised $180mm in its third equity round led by Insight Venture Partners and Accel Partners and existing investor Sequoia Capital,

- TMX Group (TSX:X) completed the previously announced sale of its wireless and extranet infrastructure services businesses known as TMX Atrium to Intercontinental Exchange (ICE). Marlin & Associates acted as the exclusive financial and strategic advisor to TMX.

Please see our full May 2017 Market Update, here.

We will be attending The Benzinga Global Fintech awards on May 11th in New York. To arrange a meeting there, please contact Michael Maxworthy at max@marlinllc.com.

We will also be attending the ETA Transact conference in May 10th – May 12th in Las Vegas. To arrange a meeting there, please contact paul@marlinllc.com.