B2B fintech m&a is alive and well in the middle market. Values and volumes remain strong. Companies continue to innovate and grow. Interest from both strategics and financial sponsors remains high.

Want evidence beyond what the industry rags are saying? We’ve already advised on four B2B fintech m&a transactions in these first two months of the year and our pipeline is strong.

Buyer/investor interest is not limited to the US. Our four deals included a UK company, a Canadian, a Swiss buyer, and our second recent m&a transaction involving Japanese investors.

We are seeing interest in B2B fintech from all corners. Its a global phenomenon.

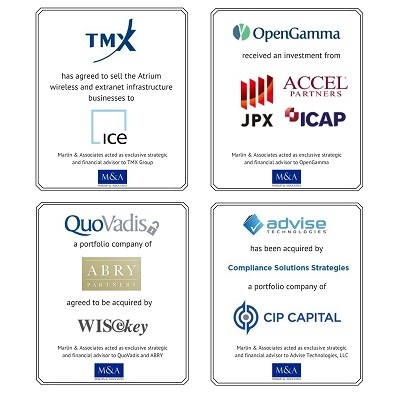

The industry is wide and varied. It includes infrastructure consolidation plays such as our recent transaction in which we advised The TMX Group (TSX: X), the owner of the Toronto Stock Exchange, on its divesture of its ultra-low latency extranet and wireless trading infrastructure technology business – which operated under the “Atrium” brand. The buyer was the Intercontinental Exchange (NYSE: ICE). More on the Atrium Transaction here.

Private Equity firms are certainly on the hunt. They are long on capital and short on good places to deploy it. B2B fintech is high on their priority list. As an example, CIP Capital backed a new governance, risk management and compliance (“GRC”) platform called Compliance Solutions Strategies (“CSS”), which then acquired our client Advise Technologies, a provider of regulatory reporting software for investment management firms. More on Advise here.

Venture firms as well as industry players looking to participate in highly interesting innovative earlier-stage B2B technology companies also remain highly active. As an example, we recently advised London-based OpenGamma, a true pioneer in open source financial software and a leading provider of derivatives risk analytics, on a strategic investment from the Japan Exchange Group (“JPX”), Accel Partners, NEX (formerly known as ICAP), Euclid Opportunities and ex-SunGard CEO Cristóbal Conde. More on the OpenGamma transaction, here. (This transaction followed on our work last year with Xignite, the Silicon Valley-based provider of market data cloud solutions for financial institutions and financial technology companies, which we advised on its Series C funding round led by Tokyo-based QUICK Corporation, part of the Nikkei Group and Japan’s largest financial information provider.)

And there is plenty of interest in the cybersecurity world as well. As an example, we recently advised QuoVadis, the Hamiltion Bermuda-based global provider of managed Public Key Infrastructure (mPKI), Certification Authority (CA) and electronic signature services (eID) and a portfolio company of ABRY Partners on its sale of a majority interest to WISeKey, the Swiss cybersecurity and Internet of Things (IoT) company. More on the QuoVadis Transaction here.

We begin 2017 with a strong pipeline of clients looking to develop and explore strategic alternatives that range across a broad spectrum – from being a buyer or a seller to raising growth capital or partnering with a financial or strategic sponsor.

We expect another strong year for m&a transactions involving middle-market fintech firms as well as others that provide information technology, application software, online data and services and we would be happy to talk with you about your objectives.

We are proud that our clients see us as more than just a financial adviser more than a “broker” but also as a true strategic partner – a member of their team – dedicated to helping them take advantage of fleeting opportunities and navigating through challenging situations in a complex, highly competitive, interconnected, global environment.

Each win is a testament to our domain expertise, our international execution capabilities, our hands-on consultative approach, and our perseverance. We look forward to each engagement.

We are always happy to answer questions.