Dear Clients and Friends, The report found here gives our sense of the current m&a trends, values and deals in the four segments of the Enterprise Data and Analytics sector that we follow and sometimes lead. Please click here for our January Enterprise Data and Analytics Market Update. There can be no doubt that this market is large and growing. Harvard Business Review recently said that 85% of those surveyed in the Fortune 1000 have started, or plan to start, Big Data usage. According to IDC, global revenues for Big Data and business analytics are estimated to grow 12% annually…

Jan 26, 2018

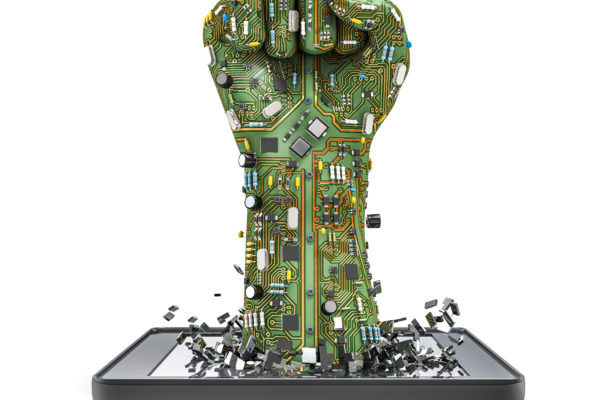

The Chinese Are Coming. Our January 2018 Enterprise Data and Analytics M&A Update

Enterprise Data, Fintech, Newsletter 0 Comments