In one of the more interesting transactions in the information space of late, Colorado-based IHS (NYSE:IHS) and London-based Markit (NASDAQ:MRKT) announced their intent to merge today. The transaction values IHS and Markit at about $7.5bn and $5.5bn in equity value (or $10.4bn and $6.2bn in enterprise value), respectively. Upon completion of the merger, the combined company will be renamed IHS Markit. We’re still trying to figure out what it all means.

The basics of the deal are all clear. It’s a merger. Since IHS has the larger market value, it makes sense that the shareholders of IHS will wind up owning the majority (57%) of the combined company and have six of the eleven board seats. From that, one might believe that IHS is buying Markit. Not so fast. IHS Markit’s headquarters will be Markit’s hometown – London, and while IHS Chairman and CEO Jerre Stead will stay on in the same capacity through the end of 2017, he’s 72 years old and already retired once (Stead was Chairman and CEO of IHS from September 2006 until June 2013). When he stepped back into those roles in June 2015, it was only a matter of time before a search would get underway for a replacement. Looks like IHS just found its future CEO. Markit’s founder Lance Uggla (53) will be President and will take over as CEO in less than two years.

We know these two companies well. Over the past few years, we have talked to both about their strategies, tactics and a number of acquisition opportunities. We advised three different firms that were acquired by IHS and shown them others. We also recently advised Information Mosaic on its sale to Markit. We know them. But we’re not quite sure where they are going with this merger. Perhaps time will tell.

On the surface, Markit and IHS appear to be similar companies. They are both large players in the b2b digital information market; both operate internationally; both have large technology infrastructures; both have subscription revenue models with very high renewal rates. Both companies have been highly acquisitive. By our count, Markit has completed 35 m&a transactions since 2003, and IHS had completed more than 80 transactions since 1995.

As noted above, the companies have announced their intent to have the combined company be based in the UK. We’re not sure if this is an effort to lower IHS’s tax rate, or to prevent Markit’s tax rate from materially increasing, which would happen if the merged headquarters were in the US. But over time, by avoiding being taxed in the US based on global income, the merged firm should save a bundle on taxes that would otherwise be paid to the US government. (We note that this transaction would seem to avoid running afoul of the US Treasury’s definition of an “inversion,” as the US entity would control 57% of the company, below the Treasury’s 60% threshold).

There is more to this deal than potential future tax savings. The companies have announced that they see $125mm of annual cost savings – in a few years. We haven’t seen the detail but this level makes logical sense to us just from looking at their combined administrative and technology spend. But then what?

IHS and Markit have historically targeted very different customer sets with very different products. IHS has long been, at its core, a provider of business research to corporate executives and governments. It started life providing in-depth information to businesses in the oil and gas sector and that remains a large part of its business. Over time IHS expanded its energy information practice and bought its way into a wider set of business research products and services. As examples, in 2010, they acquired our client iSuppli, which provided research information to manufacturers of electronic devices and components. In 2012, they acquired our client IMS Research, and in 2014 our client Infonetics – all in the business research space.

One of IHS’s largest acquisitions was the 2013 purchase of RL Polk & Co for $1.4bn. Polk is known for its comprehensive information on vehicle registrations, ownership and repair. The company also owned CarFax, which provides used car buyers with facts such as odometer records, accident history, number of owners, and other items that could impact a purchase decision. A few months ago, they bought Canada-based vehicle data provider Carproof Corporation for $460mm to further strengthen this research business. Today, most of IHS’s 50,000+ customers are in the government, automotive, and energy sectors.

Markit, on the other hand, expanded from a very different base – selling information on credit default swaps and other credit derivatives to traders, portfolio managers and others at investment banks, hedge funds, asset managers, insurance companies, regulators and global custodians. They too have been acquisitive adding other products and services aimed at this same client base. Last year, they acquired our client, Information Mosaic, which helps asset managers receive, process, and manage data related to the securities that they hold. Today, most of Markit’s 3,500+ customers are still investment banks, asset managers, hedge funds, insurance companies, regulators and global custodians.

We’ll have to wait to see the strategy that will bring these diverse firms greatness for the future. We’re sure the merger is intended to be about much more than savings on admin costs, lower tax rates or empire building. We just haven’t yet quite figured out what it is.

We wish them well.

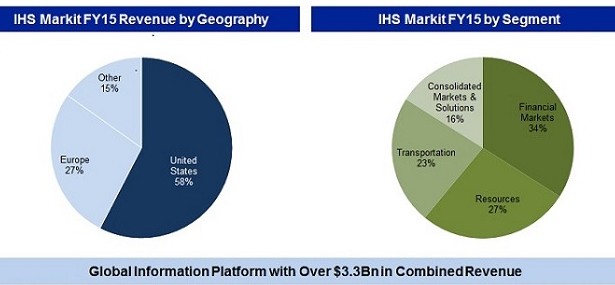

Some deal metrics on the proposed IHS / Markit transaction below: