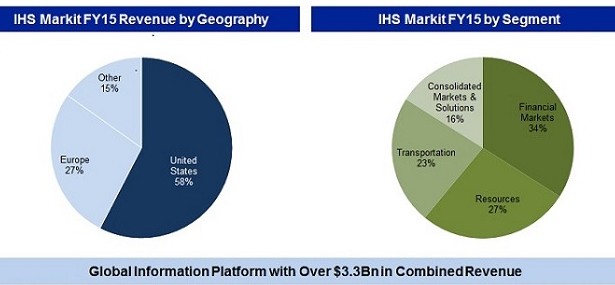

The press was filled this month with mega-deals such as Deutsche Börse coming together with the London Stock Exchange in a $30 billion merger; Markit and IHS merging in a $10 billion deal; and Nasdaq acquiring the ISE Options Exchange. But for us, it’s some of the smaller deals this past month that seem both interesting and particularly relevant in light of some of our recent blog pieces.

Apr 12, 2016

Young Guns vs. Megavendors – April 2016 M&A Market Update

Award, Fintech, Market Update, Newsletter 0 Comments